Upon discovering hedge funds were short selling GameStop, individual investors created a movement to artificially increase the price of GameStop by putting billions of dollars into the company’s stock.

The situation began when hedge funds began to short sell GameStop; short selling is a practice hedge funds often utilize,where they bet on a company’s stock price falling in order to make money.

Business department coordinator Mike Darcy describes the process as a big hedge fund deciding to sell all of their stock in a certain company, while simultaneously betting the price will go down.

“Then you see the other 50 million people also selling their shares because they see the stock price going down. It creates a weak signal for the company,” Darcy said.

According to sophomore Connor Bache, when everybody wants to sell their share in a stock and there is no demand for the stock, then the price will fall “dramatically.”

By doing this, hedge funds can make large sums of money at the expense of “everyday Joe investors,” Darcy said.

The movement to drive up the price of GameStop was created by investors on Reddit, a social media platform. According to sophomore Mikayla Baker, the specific subreddit known as r/WallStreetBets was responsible for the popularity of the GameStop stock.

“They were trying to get a ton of people to invest in GameStop. It created this movement that spread all across the internet,” Baker said.

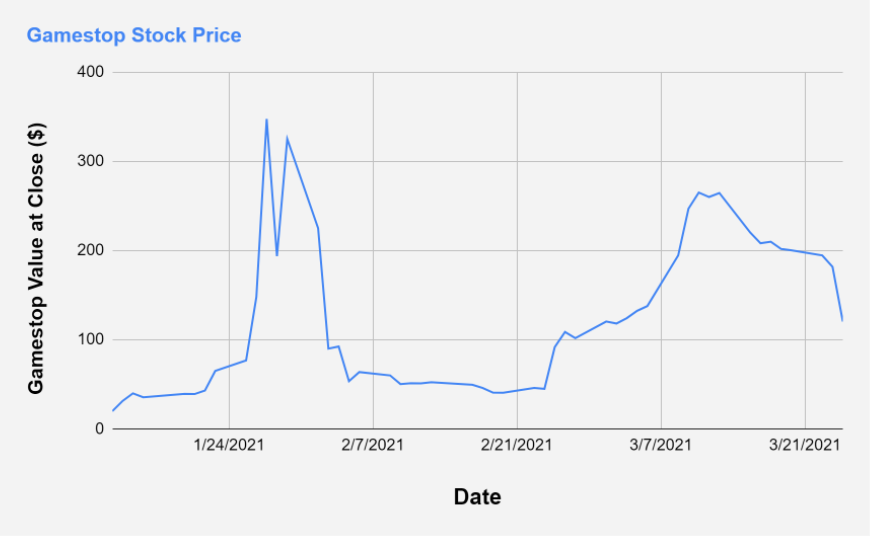

According to Bache, the initial investors in the r/WallStreetBets subreddit saw an opportunity as the stock price was rising. Bache mentioned that the investors had bought the stock when the cost was $40 but after the movement was popularized the price “skyrocketed” up to $350.

“It got to $350 and these guys were like ‘okay, let’s sell all of our stock.’ So they did that and they made tons of money off of it,” Bache said.

During these events that took place late January, stock trading app Robinhood shut off buying ability to its users. Robinhood temporarily did not allow traders to buy shares of GameStop, AMC, Nokia, BlackBerry, and Bed Bath & Beyond, which were all being short sold, as well.

“They were not allowing anybody else to buy more stock to extend the price even higher, or sustain it,” Darcy said. “It forced everybody to sell, which drove it back down.”

According to business teacher James O’Neill, it is reasonable that hedge funds have been working together to influence the market for their own interests beyond just the GameStop short sell.

“Who says that the hedge funds don’t chat about what they are purchasing and decide ‘let’s all buy Coca-Cola today’ and they inflate their own value?” O’Neill said.

According to Darcy, most individuals do not have the purchasing power that a hedge fund has to change the price of a stock on their own. “These companies will go and buy a million shares,” Darcy said. “I can not go out and buy a million shares at GameStop.”

According to Darcy, although individuals do not possess the “capital” to change the price of a stock on their own, he believes that it has been shown what people can do if they buy stock together.

“If I can find a million people to buy a million shares of GameStop and drive that price up, then I am a part of the party,” Darcy said.

Some people who were not previously involved in the stock market became more interested after the GameStop stock squeeze. For Darcy, it showed people that anybody can take $100 and if it is the right investment, can make thousands of dollars off of it.

Some are interested in having “a new generation” of investors in the future.

“I think the buzz about it just creates more investors down the road,” O’Neill said. “It educates people and they learn more, and that is always a good thing.”

Investors clash with hedge funds using GameStop as middleman

Displays of unity and mass investing have created large losses for corporations after stock traders became aware of hedge fund practices. The magnitude of the situation drew in many new investors.

**Price explosion…** *Fluctuating GameStop stock prices through late January to today caused by a new movement in the investing community. The price of the stock peaked January 27 when it reached \$347.51 at closing time, 4:00 p.m. ET.*

*Graphic created by Patrick Rother, information gathered from Google Finance*

0

More to Discover

About the Contributor

Patrick Rother, Co-Editor-in-Chief